EXECUTIVE SUMMARY

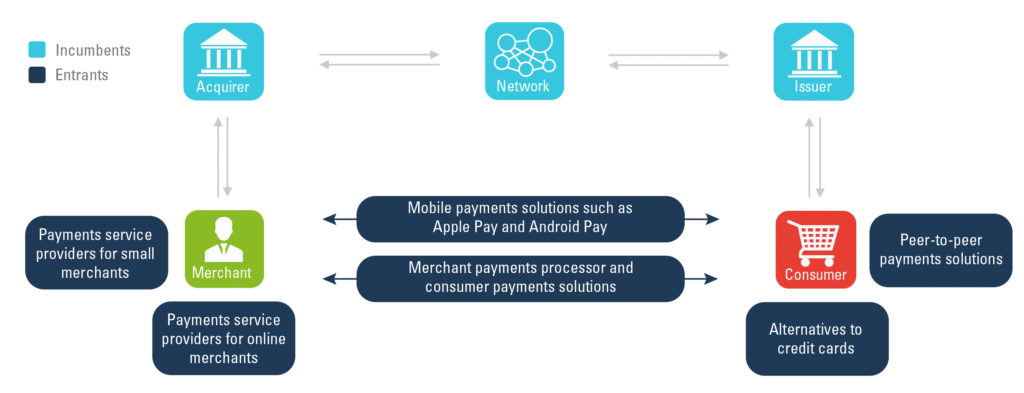

There is a lot of excitement surrounding the influx of startups entering the financial services business. And with that excitement comes a lot of talk of disruption. It seems that nearly every new entrant is labeled as “disruptive” resulting in bewildering assessments that everyone will cause disruption in financial services. But is that really what is going to happen? Or, is there more to it than meets the eye? In this paper, we apply the Theories of Disruptive Innovation to shed light on a particular segment of the financial services space: payments. Why is it worth special analysis? First, because the ability to make and accept payments is fundamental to commerce. It is necessary for anyone involved in either the purchase or sale of goods and services. Even before we can avail credit, we need the ability to make and receive payments. Second, payments services is the only area within the industry where technology giants such as Apple and Google have made their initial entry. Of course, there is no shortage of startups. But, our analysis reveals that incumbents—traditional banks and credit card networks—are prepared to fight with entrants. And many are in a position to win. While entrants entering the space may cause institutional changes to occur, disruption is unlikely to happen.

You may be interested in reading:

Banking on Disruption: The rise of online lenders and the FinTech fallout

Banking on Disruption: Digitization, FinTech, and the future of retail banking