Coding bootcamps are undeniably big business these days, and capital is flowing into the space at a dizzying pace. In 2018 and 2019, acquisitions alone saw at least $1.4 billion change hands—many deals have been done on the private market, with terms not disclosed. The most well-known bootcamps are increasingly jockeying for position, seeking to buy or be bought, partnering with universities, enhancing their corporate training divisions, and more. Each move potentially changes the set of learners these bootcamps can reach, as well as the nature of the impact they can have on higher education as a whole.

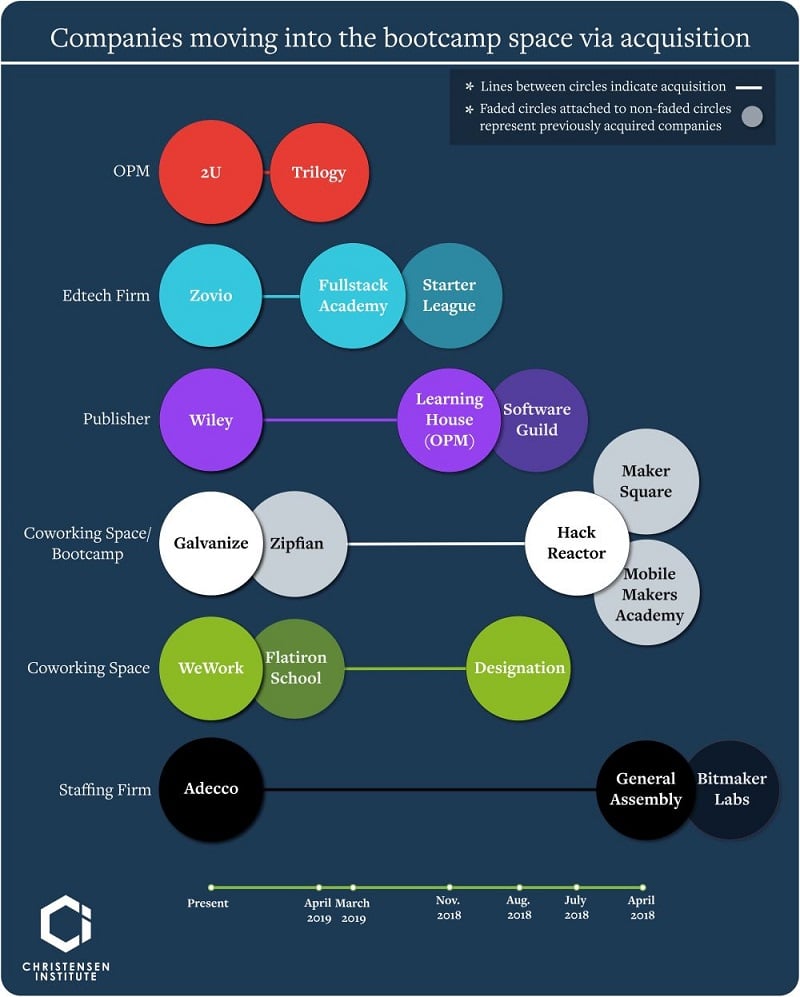

Bootcamps seeking help for such moves often turn to firms like Tyton Partners, an investment banking and strategy consulting firm focused on the global knowledge sector. Tyton Partners advised Fullstack Academy on its sale to Bridgepoint Education (now Zovio) and Hack Reactor on its sale to Galvanize, for example. We sat down with Rich Flynn, a Managing Director at Tyton Partners, for an investor’s perspective on strategic developments in the bootcamp space, and how those dynamics could shape the bootcamp model’s evolution.

Richard Price: The coding bootcamp concept seems to have survived the doldrums of 2017, which saw a number of high-profile closures. Do you see staying power in this market?

Rich Flynn: The noteworthy closures in 2017 (DevBootcamp/Kaplan and Iron Yard/Apollo) were very parent company-specific in nature and revolved around strategy, execution, and focus challenges—they were not a reflection on the bootcamp model’s significant potential.

The underlying labor market supply and demand imbalance for technology skills (several million unfilled positions across coding, data analytics, and cybersecurity over the next five to six years) and the digital transformation occurring in all industries has led employers to embrace graduates from non-degree programs that focus on industry-aligned, job-ready skills. We believe these tech skill gap fundamentals will drive sustained growth.

Richard Price: Should colleges and universities be worried?

Rich Flynn: It depends on the institution. For the most part, universities are not well-equipped to offer tightly industry-aligned non-degree programs targeted to adult learners. However, there are opportunities to partner with players like Trilogy/2U, Fullstack/Zovio, and Software Guild/Wiley to offer these programs and become more relevant to employers in their communities. Longer-term, it will be interesting to see if universities embrace accountability and transparency around student employment outcomes. To date, Trilogy partner universities have not reported outcomes against any standard we are aware of. Will prospective students ultimately expect more transparency from universities when they are able to find it from other providers?

Richard Price: We’ve observed a bifurcation in the bootcamp market, with some leaning heavily into corporate training and others seeking those university partnerships. Do you see the same?

Rich Flynn: We are seeing increasing B2B training opportunities among companies that have had good experiences hiring bootcamp graduates. The demand for reskilling and upskilling existing employees is quite high, and we expect more B2B activity. However, few bootcamps have meaningful B2B practices at this point, mainly Galvanize and General Assembly. Creating a successful and sustainable B2B platform requires dedicated resources that only the largest players have been able to invest in to date.

The emergence of bootcamp and university partnerships over the past three to four years is noteworthy. Trilogy was the first to successfully develop this model, and other players are following suit. We also expect to see OPMs develop non-degree offerings as universities seek to become more relevant with adult learners and employers—and look for new, complementary revenue streams.

Richard Price: What are the key metrics or business model elements you consider when evaluating a bootcamp? Which design decisions most excite investors these days?

Rich Flynn: Ultimately student employment outcomes, measured against a rigorous and transparent set of criteria that prospective students understand, are the most important metrics. Other important metrics are unit economics and key financial drivers like student acquisition costs, instructor efficiency, and campus cost structure. More recently, investors and strategic acquirers have shown the greatest interest in models that have partnered with universities and online models that are viewed as more scalable (Springboard, Thinkful, and Lambda School have all had success raising capital).

Richard Price: How does the investor community weigh a bootcamp’s ability to address access and equity concerns in its business model?

Rich Flynn: In general, investors have not emphasized access and equity as major elements in their evaluation of investment opportunities—the predominant focus (not surprisingly) is on scalability. While many of the larger industry players have pursued diversity initiatives (Fullstack/Grace Hopper, General Assembly/Code Bridge, etc.) and employers have strongly supported these efforts, they’ve largely not been major revenue drivers to date.

We believe that underrepresented populations can be successful in bootcamp-style models, but some students may require longer-form programs with more scaffolding in order to achieve quality outcomes. These models will likely require greater levels of employer or governmental resources to support a different type of cost structure.

Richard Price: What could regulators do to drive student outcomes?

Rich Flynn: Overall, we favor a limited regulatory framework that allows for industry-developed standards to emerge without stifling innovation. The regulatory environment has been quite manageable for bootcamps, such that leading industry participants created CIRR several years ago to develop a consistent set of criteria for measuring student outcomes. The CIRR standard is a good example of industry self-regulatory efforts that have attracted many best-in-class bootcamps and drive a high level of accountability.

The increasing availability of ISAs also aligns incentives between education institutions and students. Ongoing regulatory flexibility with respect to these financing models would be a positive.

Richard Price: How much potential do you see for the bootcamp model to expand beyond tech?

Rich Flynn: As employers have continued success with bootcamp graduates, we believe they will be increasingly open-minded relative to other job roles. To date, there have been few noteworthy models outside of tech—PrepMD (for medical device specialists) and some models focused on sales (SVAcademy and Vendition).

One factor that helps tech-focused models is that tech skills are fairly easy for employers to assess relative to many other job roles. While healthcare also has very positive future employment dynamics, the clinical training requirements for many roles and the—often very prescriptive—state regulatory environment create more challenges for bootcamps.

Richard Price: How do you see the bootcamp market evolving?

Rich Flynn: We believe the bootcamp landscape is in the process of shifting from an ecosystem of many independent, local participants to one of larger, well-financed regional and national players flexing a broader set of capabilities and relationships. We expect to see more universities offering non-degree programs through OPM partnerships, co-working players like Wework and Galvanize leveraging large real estate footprints, and staffing companies like Adecco providing employers with insights into critical pain-points that require a training solution.

We also believe that an online/hybrid delivery capability will become increasingly important, as will outcomes-based financing strategies like ISAs. As the industry matures, it may become more difficult for strictly place-based, independent players to compete with university brands and other deep-pocketed organizations than can exploit numerous employer relationships.