On December 16th, patients who rely on EpiPen received an early holiday “gift” when Mylan Pharmaceuticals, the EpiPen manufacturer, announced that a generic form of the auto-injector would be immediately available at a 50% discount. This change is the result of steady pressure from public and regulatory sectors over the past few months, and it is welcome news for many patients for whom this life saving device was simply becoming unaffordable (in the past year EpiPen’s costs had risen to $600 for a pack of two injectors). Much more can be done, however, considering that the new generic device is still being sold for more than three times EpiPen’s price ten years ago.

The new Republican-led Congress is planning to draft additional regulatory measures to curb rising drug prices. Although these developments are encouraging signs that drugs will become more affordable, a more fundamental change is necessary. Rather than look to increased regulation as the answer, the government must instead work to remove barriers that prevent the emergence of innovative technologies and business models responsible for low-cost alternatives.

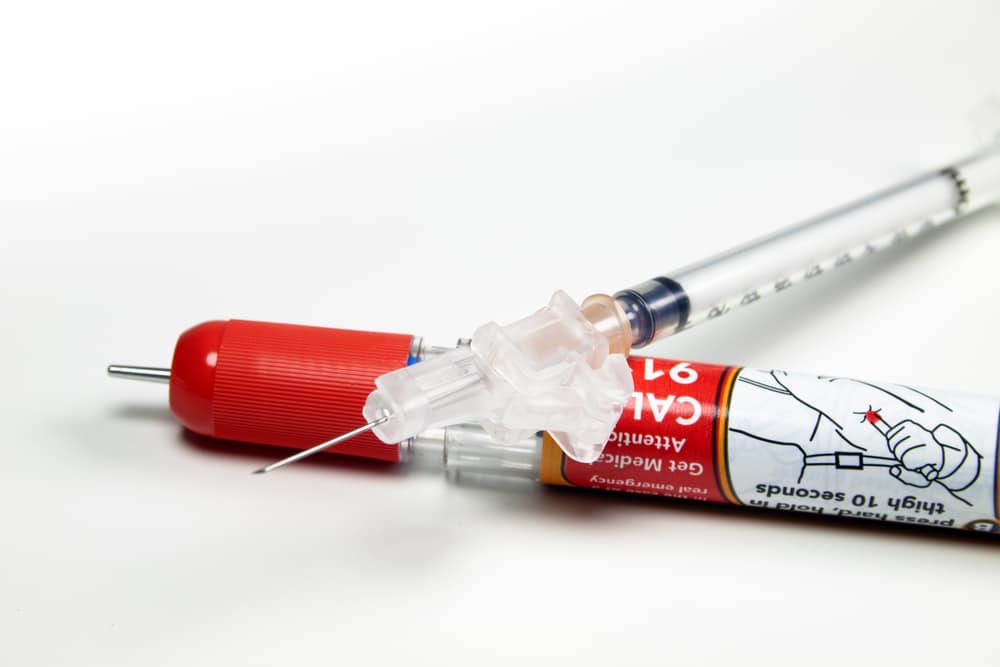

In case of EpiPen, industry insiders have already indicated that each device costs no more than $30 for Mylan to produce, yet the company is able to charge as much as $300 per device because it is patent-protected. Patients who require epinephrine, however, do have other options at their disposal. In an earlier blog, I indicated that there are $20 alternative solutions for EpiPen that allow users to inject epinephrine without the auto-injector. In fact, some emergency medical technicians (EMT) are already using them. For the public, however, the inconvenience of use and lack of training act as barriers to adopting these low-cost alternatives. Even before EpiPen’s patent expires, this is where disruptive innovations can substantially lower the cost of epinephrine injection by making these alternatives more accessible.

In his 2009 book, The Innovator’s Prescription, Clayton Christensen, a professor at the Harvard Business School and founder of the Christensen Institute, posits that disruptive innovations based on an enabling technology and a new business model make healthcare solutions simpler, more accessible, and affordable. Such innovations are critical to reversing the current trends of healthcare becoming more complex and expensive, as well as alleviating rising drug prices. At the moment, EpiPen’s $20 alternatives are not being adopted by the majority of people in need since these options lack an easy-to-use injector and require the user to manually prepare the shots. However, an innovative technology or a new delivery process that makes inexpensive pre-made kits available could remove these barriers to adoption.

One of the reasons why healthcare’s delivery of solutions has not changed much over the years is its strict regulatory environment, designed to prioritize safety. While safety remains a top concern in the development of drugs and devices, innovators must be able to come up with simplified alternatives that can reach patients in need without countless hurdles standing in their way. In response to the rise in drug prices many people are pushing for more regulations and control over pricing of drugs and other life-saving healthcare solutions. As evidenced by Mylan’s introduction of a less-expensive, generic alternative to EpiPen, such pressure certainly helps to curb the raging costs of these products. However, over-regulation actually inhibits innovation, preventing low-cost solutions from emerging.

Instead, our focus on regulatory influence should be channeled towards providing incentives for innovations rather than rules that limit the ability to hike prices or set a price ceiling. For example, providing regulatory fast tracks to allow $20 EpiPen alternatives to receive quicker approvals is a more productive strategy than forcing Mylan Pharmaceuticals to reduce the price down to a “reasonable” level. A regulation seeking to hold a drug’s price to a specific dollar amount is limited by the cost of production—in EpiPen’s case, approximately $30 per pen, or $60 for a pack of two. However, a new business model offering a ready-to-inject epinephrine syringe for $20 can be profitable by selling a pack of two for $40.

The government can further help disruptive innovations flourish by providing research funding for innovative ideas. Although low-cost EpiPen alternatives are potentially game changing for society, the financial implications of such innovations may not be attractive for many investors, because the market lacks significant growth potential. Unlike other disruptive innovations that target a large population of consumers who currently do not purchase existing solutions, all patients who depend on epinephrine-injection products already purchase them in one form or another. Typical investors may be less interested in targeting that same population with cheaper alternatives, effectively reducing a multi-billion dollar market into a $100 million market. Further, investors may be cautious of investing up-front in costly and risky research and development projects. However, government investments in the form of grants or contest prizes could provide a path for some of these “out-of-favor” projects to get a needed boost.

Disruptive innovations have the ability to permanently transform the way in which we consume healthcare solutions, but they need to be given the opportunity to thrive. With that in mind, the government should create an environment that allows entrants with potentially transformative ideas to become competitive and profitable. Only then will lower-cost healthcare solutions become available to everyone. While the public discourse surrounding EpiPen’s pricing continues, let us use this opportunity to challenge existing processes and revamp our approach to delivering affordable healthcare products for all.

For more, see: