The Government Accountability Office (GAO) recently released a report showing that the Department of Education’s primary financial health test failed to predict 60% of last year’s school closures in higher education.

What’s behind this profound disconnect? As it turns out, the metric guiding the test, known as the Financial Responsibility Composite Score, hasn’t been updated to keep up with accounting standards in 20 years. But the composite score isn’t just out of date and ineffective. It’s actually distorting incentives across the higher education industry.

As its name implies, the composite score is intended to reduce the complexity of a school’s financial position into a single number. A healthy score indicates eligibility for federal financial aid. Scores that fall below a certain threshold trigger additional scrutiny from the Department of Education. Some have also suggested that prospective college students consider this metric when deciding where to go to school.

A lot rides on this little number.

Originally designed to identify financially unstable institutions, the score instead may actually have contributed to the financial instability of the entire industry—and in ways that now may be difficult to change. To understand how this one number could have such massive implications, it’s important to grasp how business models coalesce and solidify—and all organizations, even non-profit and public entities, have a business model.

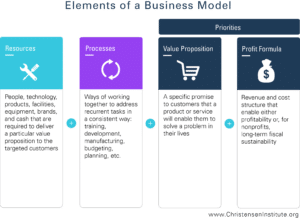

The building blocks of a business model

First, an organization identifies a value proposition—a promise made to customers, in this case students, that they will be able to solve a problem in their lives. The organization delivers this value proposition by assembling the right resources—people, technologies, buildings, etc—and developing processes, or habitual ways of getting recurrent tasks done. A profit formula emerges, and the organization continually refines its value proposition and processes to satisfy its best customers and maximize financial stability. To the extent that organizations are successful, these four business model components—value proposition, resources, processes, and profit formula—become interlocked over time and difficult to change. The way that colleges and universities operate today results from the specific incentives that influenced the development of their business models.

Where things went wrong

The composite score gates access to Title IV dollars, which in turn shapes these four interconnected components of colleges’ business models. Without properly taking the potential effect on these components into consideration—and under pressure from higher education institutions—regulators chose to allow long-term debt to be included in a calculation of assets that makes its way into the composite score. (In the financial and accounting world, debt is generally considered a liability, the opposite of an asset). Institutions argued that counting their debt against their financial stability would discourage them from investing in their campuses. The net effect has been that schools could improve their composite score, a financial responsibility metric, by borrowing a lot of money for long periods of time.

Predictably, business models solidified around these market incentives and schools gamed this system. Schools with borderline problematic scores could improve their position by borrowing money, boosting their scores and thus avoiding unwanted additional oversight. The most egregious example is Corinthian College, which took out loans worth tens of millions of dollars right at the end of their fiscal year in order to include it in their composite score, and then immediately paid them off. For three consecutive years. By the time the Department of Education caught on, it was too late, and American taxpayers are $550 million poorer because of it.

The problem, however, extends well beyond a handful of bad actors. Nudged along by the incentives built into the composite score calculations, schools have been taking on debt. Higher education debt issuance tripled to $33 billion between 2000 and 2006. Recent estimates put the outstanding debt value at roughly $250 billion in 2016. The proceeds have started an arms race. Schools are sprucing up their campuses with shiny new dorms, academic buildings, stadiums, and more in order to attract prospective college students in an increasingly competitive market. As a result, instead of directing precious resources toward innovative instructional initiatives like online learning, school are spending to maintain these expensive new facilities and service debt. Since 2004 there has been a 10% increase in per-student campus operations and maintenance costs at public institutions, and per-student interest costs have gone up by over 60%—despite interest rates being half of what they were.

Climbing walls and lazy rivers are more than just expensive marketing tactics—it turns out they are considered “financially responsible.”

A better way to regulate

Over time, this spiraling arms race has become thoroughly baked into the higher education business model. Continual investment in new facilities has become a critical element of higher education’s competitive trajectory, and business models will resist changes.

This brings us to the main takeaway from this mess: the Department of Education should follow the GAO’s recommendation to overhaul the composite score. But more broadly, higher education regulators must internalize the importance of operating within a business model context, not just an educational one. While it is unreasonable to expect that regulators anticipate every possible unintended consequence, it is not unreasonable to expect savvier, commonsense rules that avoid foreseeable and hopelessly expensive mishaps. Understanding the moving parts of higher education’s business model is a fundamental aid in developing such rules. The GAO’s recent report shows what happens when business models are not properly accounted for, as higher education institutions have molded themselves into the version of financial responsibility required of them. Campus buildings are beautiful, but colleges are indebted and students are too—regulators should be careful what they ask for.