This guest blog was written by Katie Zandbergen, community manager at The Forum for Growth & Innovation at the Harvard Business School. Katie earned her PhD in Comparative Social Policy at the University of Oxford, and is particularly interested in how the Theories of Disruptive Innovation apply to poverty and education.

M-Pesa, Kenya’s largest mobile-money transfer service, made headlines last month when it struck a deal with Western Union to launch M-Pesa Global. The Venmo-esque service is the protagonist in a tale of global prosperity to which we all can look for lessons on the impact of market-creating innovations—yet the company’s roots are far more humble.

Prior to its introduction in Kenya, the situation was such that many breadwinners from rural areas traveled to urban centers for work and then, to get the money they had earned back to their families, often endured long trips home or had to trust someone else to deliver the funds. As Vodafone explains on their website, “These people didn’t have access to financial services, and in rural areas there was little, if any, traditional banking infrastructure.” In fact, the traditional banking system had largely ignored this group, as they didn’t have much money and the majority didn’t have access to brick-and-mortar bank branches. However, where many would-be entrepreneurs might have looked at this situation and seen little potential for successful enterprise, M-Pesa saw opportunity.

Though they may not have used the term, M-Pesa’s leadership came to realize that their future customers had a Job to Be Done—that is, in a given circumstance (in this case, struggling to get money back home without the necessity of an arduous journey), people wanted to make progress in their lives. In 2007, with this knowledge in-hand, Vodafone’s Safaricom launched an affordable, accessible, and simple solution to fulfill that job: a person-to-person money transfer service, known as M-Pesa. Using M-Pesa’s services, anyone who had access to a mobile phone could, regardless of whether they had a bank account, send and receive money. Though Bob Collymore, the CEO of Safaricom, described the service offering as “far from elegant” compared to other tech products, Kenyans with this ability in the palm of their hands saw radical improvements in their daily lives.

M-Pesa’s money transfer service is what we call a market-creating innovation—it created an entirely new market by transforming a formerly complex service (banking) into one that was simple and affordable, such that many more people who formerly lacked access could use it. In doing so, what began as a small venture to fill a gap in Kenya’s formal banking network has, over the last decade, emerged as an explosion of growth, new developments, fruitful partnerships, and exciting opportunities for both Kenyans and for the company.

From the perspective of those using M-Pesa’s services, the ability to easily send and receive money has enabled users to conveniently pay for a myriad of products and services, both at retails stores and online, for instance, through Safaricom’s Little Cab, using the music streaming service Songa, on the e-commerce platform masoko.com, and with Bonga, a messaging service. Furthermore, a 2012 study out of MIT found that M-Pesa helps Kenyans to better manage circumstances in which they face financial uncertainties, such as when in poor health or during a drought, because M-Pesa customers have access to a broader support network, one through which they can quickly receive payments from family and friends when in need of a financial crutch.

As is common with market-creating innovations, M-Pesa has also contributed to the economic development of the countries in which it operates. The service has, for instance, empowered many Kenyans to start their own enterprises, with increasing numbers opting for employment in the business sector over farming. This has helped to lift significant numbers out of poverty. M-Pesa’s boost to commerce in Kenya has also spilled beyond the country’s borders, as the company now employs over 285,000 agents in ten countries and is hoping to make future inroads into Ethiopia, a market with enormous potential.

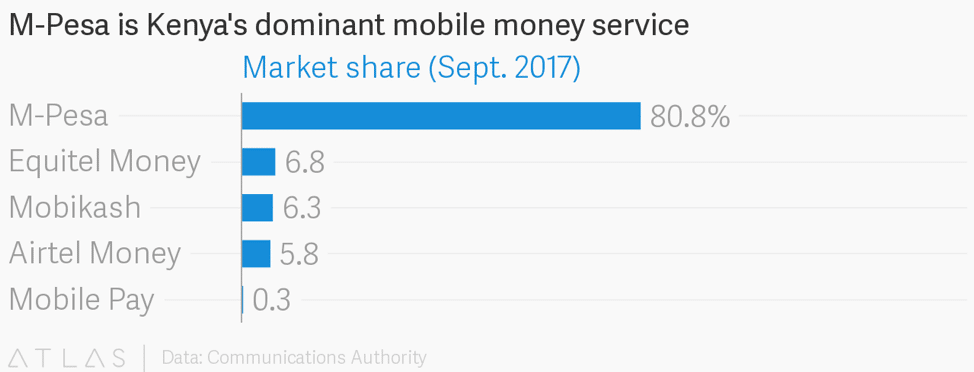

In Kenya last year, M-Pesa’s revenue increased by 14.2%, to nearly 63 billion shillings/$615 million USD. M-Pesa also dominates the country’s mobile money service market:

Given M-Pesa’s success, the company was able to establish the M-Pesa Foundation, which invests in projects that improve social and economic conditions in Kenya. Along these lines, M-Pesa has employed its platform to introduce convenience and accessibility to other much-needed areas. For example, M-Pesa plays a crucial role in the Vodafone Foundation’s health services, allowing people in rural areas to pay for transport to treatment centers and helping doctors to track patients in remote areas; the company partnered with M-Kopa, permitting anyone with a mobile phone to buy solar energy; and a partnership with Ericsson enables residents in local villages to make M-Pesa payments at clean water pumps. Constantly innovating and expanding its reach, the recent launch of M-Pesa Global grants customers a connection to Western Union’s 500,000 agents in over 200 countries. Imagine what the future holds! Clearly, M-Pesa has created a ripple effect of tremendous positive impact, and the company has thrived.

The moral of the M-Pesa story is that in order for prosperity to take root, it is to market-creating innovations that we should turn. With an eye to low-income countries, innovators need not wait for strong institutions to first be founded, for the right regulations to be enacted, or for strong infrastructure to be in place before considering these markets as fertile ground for building and sustaining successful enterprises. Entrepreneurs would be well advised to put on a new set of lenses, first looking to find unfulfilled Jobs to Be Done and then working to address them through the development of market-creating innovations. Society has much to gain when companies work to establish solutions that help people who are, in a particular circumstance, struggling to make progress. Truly, as we’ve seen in the case of M-Pesa, the impact of market-creating innovations, for both companies and the communities they serve, is immense.