Deal fever is slowly creeping into higher ed. According to research from TIAA Institute, there have been 24 mergers in higher ed during the last decade, more than double the pace of the preceding three decades.

Is consolidation the answer to what ails higher education? Could merging institutions lower costs and unlock value for students, society, and institutions themselves? Can acquisitions make colleges more innovative? Higher ed isn’t the first industry to ask these questions, and innovation theory has some answers that could help colleges think through their strategic options.

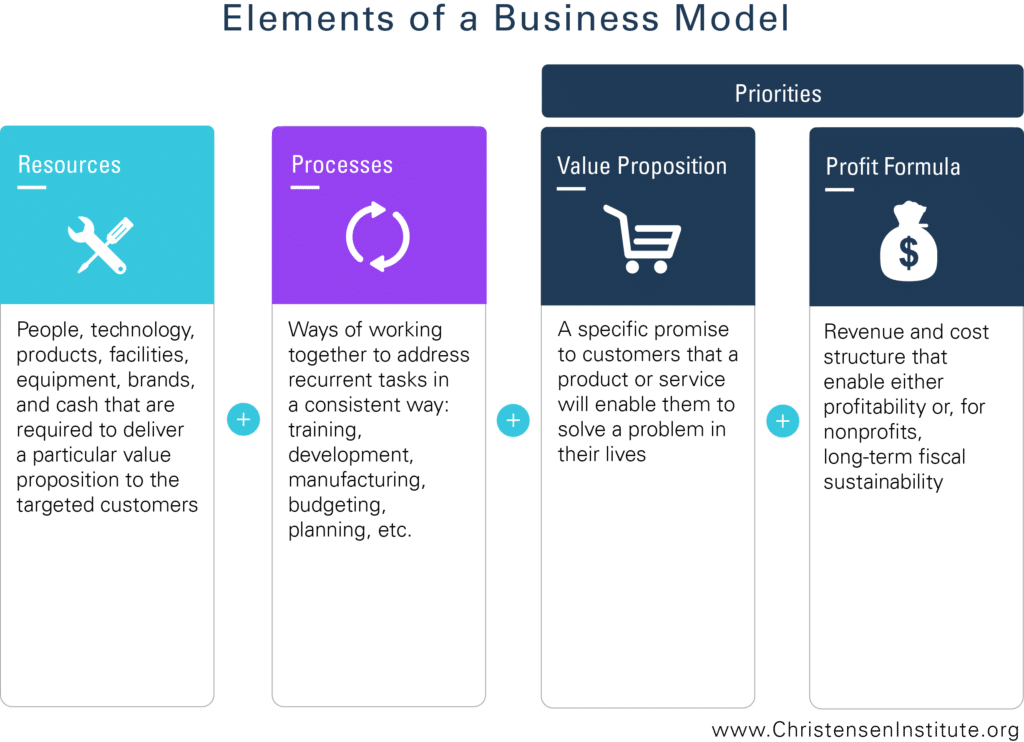

In a 2011 article on M&A activity, Clay Christensen describes that successful acquisitions fall into one of two categories: they allow organizations to leverage the performance of the business model they already have, or they allow organizations to reinvent their business model. All organizations, even non-profits, have a business model, and those business models define what an organization can do successfully. Business models are more than just dollars and cents—they include resources, processes, and priorities.

Leverage my business model

The first type of deal—”leverage my business model”, or LBM—is more common, and typical ways of boosting the current business model include cutting costs or increasing scale. In higher education, these often include deals that allow institutions to merge and streamline administrative overhead or acquire new space to expand profitable offerings. LBM deals rarely make big headlines, but if done well, they can help struggling colleges to improve their offerings, and they can help successful colleges to grow.

In LBM deals, organizations are essentially buying resources, which include people, facilities, brands, and financial resources. Successful LBM deals require institutions to share similar priorities, and those priorities should remain more or less unchanged by the acquisition. LBM deals hold particular promise in industries—like higher education—which have high fixed costs.

One successful LBM deal is the 2015 merger between two Minnesota law schools, Hamline and William Mitchell. Now known as Mitchell Hamline, this merger allowed law schools struggling to attract students to pool their resources and compete successfully. So far, this tie-up has seen success at stabilizing enrollment and creating new, innovative programs, like its first-of-its kind hybrid JD program.

One challenge in higher education is that because such mergers have historically been rare, many schools turn to them only as a last resort—when resources are already scarce. Considering consolidation before an organization is in dire straits can make it easier to find schools to partner with, and can improve the odds of a successful deal.

Reinvent my business model

The second type of deal—”reinvent my business model”, or RBM—is far more rare, both in higher education and in other industries. In RBM deals, organizations aren’t pursuing a deal in order to augment their business model; they are seeking to build an entirely new one. For this reason, RBM deals demand an entirely different post-acquisition strategy: rather than integrating the organizations in order to achieve synergies, the two should remain separate and distinct.

The Purdue/Kaplan deal fits in this category. Purdue partnered with Kaplan because it wanted to pursue an entirely new value proposition: online education for adult learners. Rather than mashing the two schools together, Kaplan’s assets were kept completely separate from Purdue’s main campus in West Lafayette, Indiana, and will be managed autonomously as Purdue University Global.

A major mistake that organizations can make is to pursue an RBM deal—and then push for integration and cost cutting. Schools should be clear about which type of deal they are seeking, and should develop a post-acquisition strategy that corresponds with that goal.

Disruption means deals

Higher education has historically been a massively fragmented industry. Thousands of schools compete for students, only a handful have anywhere close to 100,000 students, and none have even 1% market share. But the largest schools—including Western Governors University, Liberty University, University of Phoenix, and Southern New Hampshire University—tend to have something in common: online programs.

Online programs can (but don’t always) allow schools to operate at greater scale. A few schools successfully scaling much larger programs, in combination with overall declines in enrollments across higher education, will create tremendous pressure on smaller schools. For these schools, many of which operate in a traditional business model with high fixed costs, small declines in enrollment can have big impacts on their ability to stay afloat. This has led many schools to consider closure—but LBM deals could be another option.

For far-seeing, well-resourced, traditional institutions, RBM deals offer a way for them to successfully ride the wave of disruption. Pursuing disruptive strategies inevitably requires organizations to create autonomous units. Many schools will find that it is more practicable to buy those autonomous units than to build them. But managing these acquisitions well means rejecting the push to integrate, cut costs, and achieve synergies. Instead, successful RBM deals will give disruptive business models the room to find their own way, separate from the traditional institution.