In one of his books, The Innovator’s Solution, Harvard Business School professor and Christensen Institute co-founder, Clayton Christensen, explains that investors and entrepreneurs should learn to be patient for growth, but impatient for profits. This simply means that companies should take the time to figure out their profit formula (how they intend to make money) before scaling their businesses. In a fast-paced world where everyone wants and feels the need to be first, best, and big, as quickly as possible, that advice sounds archaic. It might even sound irresponsible. There is no room for patience in today’s entrepreneurial climate, especially as digitization is upending many industries, from taxis to hotels. Speed is king. But the question you must ask is – what are you speeding towards?

This mantra of growth before profitability is pervasive, especially in the e-commerce industry. E-commerce companies, especially those in emerging markets, are growing quickly in order to corner market share. In essence, they are trying to replicate or, at the very least become the next Amazon. And why shouldn’t they? According to Forbes, Amazon’s founder, Jeff Bezos, was the second richest person on the planet in 2016, worth a whopping $67 billion. Selling the idea to investors that you can create an Amazon in your country is compelling. And few entrepreneurs are better at selling this idea than those in the Indian market.

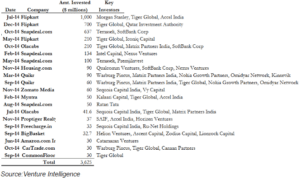

In 2014 alone, the top 20 private equity deals in the Indian e-commerce segment attracted more than $3.5 billion. And many of these deals were executed by some of the world’s most prestigious private equity shops.

Top 20 Private Equity deals in Indian e-commerce sector

These investments are supporting an Indian e-commerce sector that has grown at an impressive compound annual growth rate (CAGR) of 34% from 2009 to 2014. The industry generated approximately $30 billion in 2016 and is expected to reach $120 billion by 2020. The number of orders per month is also increasing, projected to reach 12 million in 2016, signaling immense opportunity for investors. By most measures, the Indian e-commerce industry seems poised for significant growth. And yet there have been some recent setbacks.

Nemo dat quod non habet – You cannot give what you do not have

On February 23rd, Mohul Ghosh published an article titled, Black Day for Indian e-commerce, in which he explains the “seemingly” sudden demise of several Indian e-commerce giants. Snapdeal, for instance, India’s third largest e-commerce portal, has announced that massive layoffs are imminent. 800 to 1,000 employees might find themselves jobless in the next couple of weeks. Snapdeal, Ghosh writes, is not alone.

Yepme, another fast-growing Indian e-commerce site, might cut up to 90% of its staff. If that scenario plays out, one wonders who will remain standing at Yepme or, more accurately, delivering. The biggest giant of all, Flipkart, is also having to reduce costs. The company will cut its two million square-foot office space by more than half in a cost cutting measure. Flipkart is India’s largest e-commerce player and raised at least $1.91 billion in 2014.

If the problem with the Indian e-commerce sector were not foundational, one would expect that, while the other e-commerce players are hemorrhaging cash, employees, and customers, Flipkart would be picking up some of the slack, and perhaps expanding. But its decision to reduce its space suggests that the company is playing it safe…very safe.

To replicate Amazon, you must first replicate America

Several e-commerce entrepreneurs understandably promote the “We must grow at all cost” model. They cite Amazon’s market dominance and work hard to replicate its strategy. Some founders even incorrectly reference Amazon’s seeming penchant for losses, with some thinking, “Amazon has still not made a profit today, yet it will eventually.” Unfortunately they are misguided. First, replicating Amazon, a company built on decades of American infrastructure, logistics, and technology, is anything but easy. And even if it were possible, it would require a significant amount of capital.

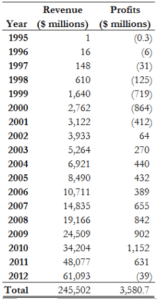

Second, Amazon made more than half a billion dollars in profits in 2015 and generated more than $11 billion in cash from its operating activities. Amazon is also not an e-commerce company, but a technology company operating on the back of America’s strong financial, human, and transportation infrastructure. Amazon did make losses during its first seven years, but the company turned a profit soon after. From 1998 to 2012, Amazon’s cumulative profit was more than $3.5 billion. Additionally, why a company is losing money, and what it can do to correct it, is more important than the simple fact that a company is making losses. Amazon was growing, reinvesting in technology, and also aggressively managing its net margins. It was not laying off 90% of its staff to cut costs.

Snapdeal’s founders acknowledged this difference when they admitted in a note to employees, “We started growing the business before the right economic model and market fit was figured out. A large amount of capital with ambition can be a potent mix that drives a company to defocus from its core.”

Amazon Revenues and Profits, 1995 to 2012

Be patient for growth and impatient for profits

There are likely still massive near-term opportunities in the Indian e-commerce sector. And hopefully these recent setbacks are only temporary market corrections. However, Indian (and other emerging market) e-commerce investors and entrepreneurs should keep the following in mind.

First, when you chase growth and scale too quickly, you will scale the good and the bad. While scaling is an important component when assessing an opportunity, entrepreneurs that scale too quickly run the risk of major setbacks in the future. Properly understanding the unit cost parameters and business model is necessary before scaling.

Second, scaling should help increase efficiencies, not reduce them. As such, even if a company is not yet profitable when it decides to scale, scaling should help its margins become more attractive. You can see that in Amazon’s numbers. The company’s revenue growth tracked very closely with its growth in losses, and almost always exceeded it. This signals to investors that entrepreneurs are getting a handle on the business and increasing market share and profitability.

Third, and perhaps most fundamental, entrepreneurs should make sure they are developing innovations that people can pull into their lives, and not simply following trends. Tech, e-commerce, and digital are all cool and trendy. However, if the solutions created by these technologies are not solving a Job to Be Done for customers, then they will ultimately become cool, trendy, and spectacular failures.

In a fast-paced world that seems to be moving at breakneck speed, it sometimes pays to be patient. Be patient for growth, but impatient for profits.