In order to maximize net tuition revenue, higher education employs a high-price, high-discount model. But just as trees don’t grow to the sky, this strategy can’t work forever—the U.S. is running out of students who can pay full tuition. Students are tapped out: in the 2014-15 school year, 86% of first-time full-time freshmen received financial aid.

This means that when schools increase tuition, only the remaining 14% of students can actually afford to pay more, creating a disconnect between raising tuition and actually getting more cash in the door. Tuition rose by 4.8% per year between 2006 and 2016—adding up to an eye-popping 60% over the past decade. But tuition revenues per student grew by only half as much. Schools are having to discount even to attract wealthy students: private four-year schools are offering 33% discounts to students whose families are in the top income quartile. There is, so to speak, very little blood left in the turnip.

The hunt for full-pay students has taken schools far afield. At public schools, out-of-state students generally pay far higher tuition than in-state students, which goes a long way in explaining why out-of-state enrollments are on the rise at most public flagship institutions. The issue is becoming politically thorny. An audit in California found that out-of-state students were able to gain admission with lower qualifications than in-state students—resulting in a legislative limit on how many out-of-state students the system can accept. A recent audit in Pennsylvannia had similar findings.

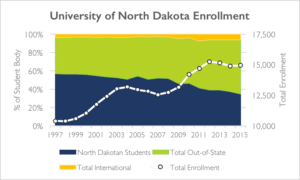

Defenders argue that colleges have been forced to reach for revenues because state governments are rapidly disinvesting in higher education. There is merit to this; most states are spending far less per student than they did pre-recession. But even in states like North Dakota, for example, which has seen a rise in state appropriations to higher education since the recession, schools are still reaching for revenue. In 2000, the University of North Dakota enrolled just over 6,000 North Dakotans, constituting slightly over 56% of the school’s population. Fifteen years later, despite boosting overall enrollment by nearly 4,000 students, the number of enrolled students hailing from North Dakota actually fell by over 1,000 students. Today, out-of-state students make up the majority of the student body.

But out-of-state American students are the small potatoes. The big game is international students—and we’ve seen their numbers rise nearly five times faster than U.S. student enrollment growth over the past ten years. In North Dakota, for example, international enrollment is now 6.1%.

International students are attractive to U.S. institutions because they bring financial resources, allowing schools to tap into a rich vein of tuition revenues at a time when affordability concerns in the U.S. are reaching fever pitch. But there are signs that this source of revenue is at risk. In March of this year, 40% of colleges and universities reported a decline in applications from international students. International students have reported that they are concerned about being able to get visas to study in the U.S., being unwelcome in the country, and not being able to work in the U.S. after graduation.

The politics and rhetoric of the current administration have not been altogether kind to foreign students. But even if the political winds were to shift, institutions face longer term vulnerability to the stream of revenues from international students: competition from abroad.

In the 2018 Times Higher Education rankings non-U.S. institutions took both the first and second spot—a first for the rankings since their inception in 2004. As international research universities become competitive with U.S. institutions, international students won’t have to travel across oceans to access elite brands. This is especially critical for Chinese students, which have come to constitute about a third of foreign students in the U.S. Over time, Chinese research institutions like Peking University and Tsinghua University have slowly built their research productivity, financial resources, and reputations, the three areas evaluated by the Times.

The end of the road for the traditional business model?

This is a big deal for U.S. colleges and universities. Faced with what is likely to be a tougher market for enrolling international students—not just in the Trump years, but over the long term—U.S. higher education may finally have exhausted its ability to squeeze more revenue out of the high-tuition/high-discount model.

In many industries, managers seeking more revenue, faced with a consumer who can’t accept higher prices, might look to increase the total number of customers, either by growing the market or by taking market share. Unfortunately this isn’t an option for the traditional higher education model, which has high fixed costs but also fixed capacity—only so many students can fit in a classroom, a dorm, or a cafeteria. In the push for prestige, colleges have prioritized maximizing revenues per student, which has left lower income students behind.

Colleges are sorely in need of a new business model. The search for full-pay students is a driver of inequality, as well as being unsustainable. Where can we go from here? This race to the bottom leaves an opening in its wake: innovative models in online and competency-based that can increase access at a lower cost to students and taxpayers. We are seeing enrollment in those programs rise as students flock to lower-cost programs with strong outcomes. Traditional higher education needs to either make fundamental shifts in its business model, or find a way to control cost growth. We are quickly running out of full-pay students, at least in this sector of the galaxy.